Mean Index Ratio

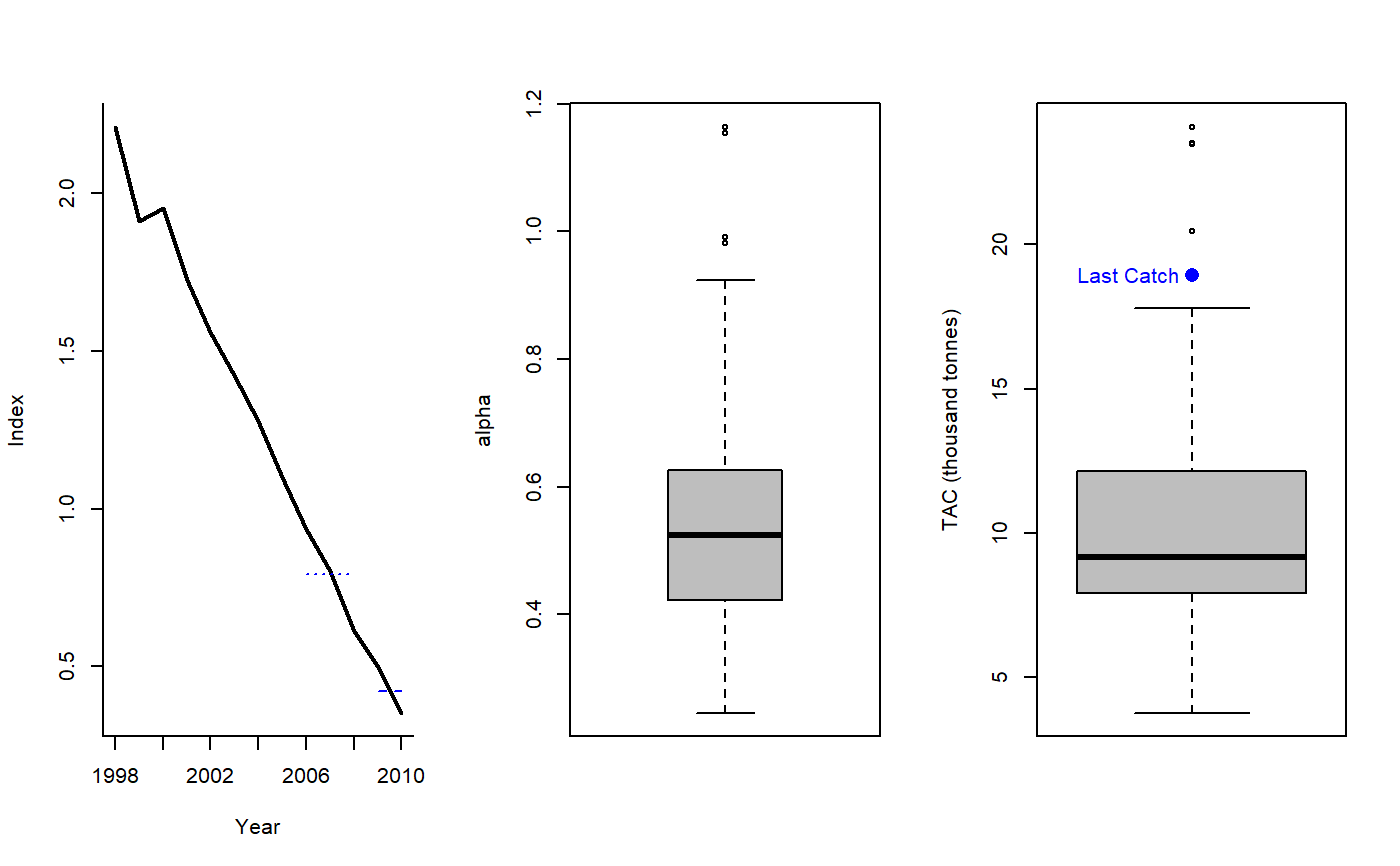

Iratio.RdThe TAC is adjusted by the ratio alpha, where the numerator being the mean index in the most recent two years of the time series and the denominator being the mean index in the three years prior to those in the numerator. This MP is the stochastic version of Method 3.2 used by ICES for Data-Limited Stocks (ICES 2012).

Iratio(x, Data, reps = 100, plot = FALSE, yrs = c(2, 5))

Arguments

| x | A position in the data object |

|---|---|

| Data | A data object |

| reps | The number of stochastic samples of the MP recommendation(s) |

| plot | Logical. Show the plot? |

| yrs | Vector of length 2 specifying the reference years |

Value

An object of class Rec with the TAC slot populated with a numeric vector of length reps

Details

The TAC is calculated as:

$$\textrm{TAC}_y = \alpha C_{y-1}$$

where \(C_{y-1}\) is the catch from the previous year, and \(\alpha\) is

the ratio of the mean index in the most recent two years of the time series and the

mean index in 3-5 years before current time (reference years are specified as

yrs argument.

Required Data

See Data for information on the Data object

Iratio: Cat, Ind

Rendered Equations

See Online Documentation for correctly rendered equations

References

Ernesto Jardim, Manuela Azevedo, Nuno M. Brites, Harvest control rules for data limited stocks using length-based reference points and survey biomass indices, Fisheries Research, Volume 171, November 2015, Pages 12-19, ISSN 0165-7836, https://doi.org/10.1016/j.fishres.2014.11.013

ICES. 2012. ICES Implementation of Advice for Data-limited Stocks in 2012 in its 2012 Advice. ICES CM 2012/ACOM 68. 42 pp.

See also

Other Index methods:

GB_slope(),

GB_target(),

Gcontrol(),

ICI(),

Islope1(),

Itarget1_MPA(),

Itarget1(),

ItargetE1()

Examples

#> TAC (median) #> 9.169036